Millions of Americans borrow signature loans in order to consolidate financial obligation, protection unforeseen expenses, deal with do it yourself methods as well as begin people. And even though its relatively easy to take out a personal mortgage, and a personal loan are going to be a stronger way of getting money easily (comprehend the most recent consumer loan cost here), it’s just not something are going to be removed softly and it may feel costly for your requirements. Listed below are six some thing masters state you need to know before taking away a personal loan.

step one. Understand the app procedure

To locate an unsecured loan, you will submit an application and have proof of the name, address and earnings. The lending company may request such things as W2s, spend stubs, 1099s, bank statements, tax returns, electric bills, financial comments, driver’s license, passport plus.

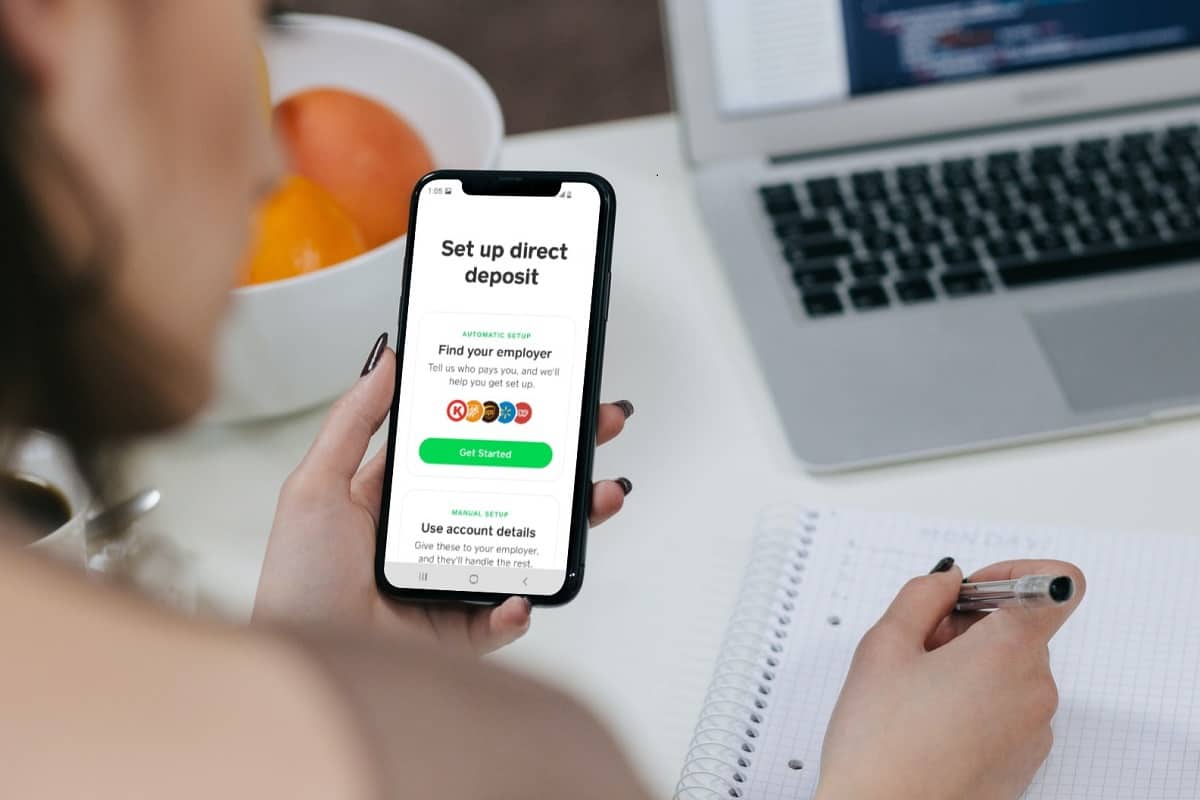

If you’re that will appear to be a great deal, fortunately that unsecured loans often financing rather easily. Unsecured loans bring an easy and quick app process, specifically as compared to lengthy, paperwork-filled experience of trying to get a house equity line of credit otherwise refinancing your own mortgage. It’s often it is possible to to apply for a consumer loan online in the a matter of minutes and if you are recognized, you can get money the following day, states Ted Rossman, senior world analyst at Bankrate. This guide can tell you loans Cotopaxi ways to get an unsecured loan.

dos. Envision other options

Its essential to understand other choices before getting a personal mortgage to be sure that it’s your own cheapest option. Sometimes, marketing and advertising handmade cards otherwise home collateral capital can help you to-do your goals and you can help you save money, says Annie Millerbernd, consumer loan professional from the NerdWallet. In reality, prices for the HELOCs and you can house security fund is all the way down than simply signature loans. This informative guide highlights the differences ranging from a beneficial HELOC and household guarantee loan when you find yourself thinking about one particular.

If you find yourself playing with a consumer loan to repay obligations, you might find that both, a loans government package offered by a reputable nonprofit borrowing therapist will include more attractive words than an unsecured loan – specifically if you have less than simply pristine credit. Many people is be eligible for something such as good 5-seasons payback identity which have a eight% rate of interest when consolidating high-pricing personal credit card debt, says Rossman.

step three. See finding a knowledgeable rates

On the internet loan providers – instance fintechs – tend to give you the better rates, advantages state. However it is practical to incorporate some common banking institutions and you may borrowing unions on your look, too. Pricing vary a great deal that you should without a doubt research rates aggressively to discover the best terms, says Rossman. (Understand the most readily useful personal loan interest rates you can qualify for right here.)

There is no reasoning locate a personal loan with no knowledge of around just what price can be expected, states Millerbernd. Prequalify with a loan provider ahead of entry an application to help you preview your own financing give. Because the pre-being qualified will not apply to your credit rating, you could comparison shop during the multiple lenders before you choose you to definitely, claims Millerbernd.

cuatro. Do a little homework on the other charges you may bear

Browse just in the rates you’ll be charged, but also at charge. Like, many signature loans were an enthusiastic origination payment, and this usually selections in one% to 8%. This is exactly one thing to incorporate to your search procedure once the you comparison shop. As well as, origination costs usually are subtracted on loan amount, so if you you desire $ten,000, but there’s an effective 8% origination commission, you will want to require next to $11,100000, states Rossman.

5. Know the way personal loans really works

A consumer loan is a loan provided because of the an online bank, bank, or borrowing relationship, constantly when you look at the a cost ranging from on the $1,one hundred thousand to help you $a hundred,000; you usually pay off them at regular times, eg each month, more than from one to eight ages.

Personal loans usually are unsecured debt, which means you generally won’t need to personally put an asset particularly as your house or vehicle on the line since the guarantee. You can acquire the cash in a single lump sum, and lenders typically aren’t that rigorous on what you are able to the bucks having. Simply note, if not repay the borrowed funds, you’ll damage your credit rating.

That said, while having problems expenses yours loan, discover days where you could sign up for an additional financing to aid pay the outdated one to. It can make experience if you’re able to reduce your rate of interest, but keep an eye on charges to help you originate brand new financing, states Rossman.

6. It’s unrealistic you will get hit that have a goverment tax bill around the personal loan

Generally there aren’t any taxation ramifications when you take aside a personal financing because it is not thought earnings. For many who end up with part of the mortgage forgiven otherwise terminated, simply after that does one to count end up being taxable due to the fact earnings, says Matt Schulz, chief credit expert at the LendingTree.

The advice, pointers or ranks indicated in this article are those out of MarketWatch Picks, while having maybe not started assessed or endorsed by the our commercial lovers.