As among the couples 100% investment alternatives kept on the loan markets today, USDA loans was an appealing option for the few potential real estate buyers that are conscious of that it regulators backed home loan program.

After you’ve heard about the many benefits of this specific loan system, you also might possibly be thinking about, what is actually to not including about this. But before we enter all of the higher perks of going a keen Oregon USDA financial, lets explore who indeed qualifies.

Being qualified to own a keen Oregon USDA Mortgage

The usa Agency out-of Farming created that it financing to support outlying invention and additionally offer capital choices to low and you may very-lower income earners from inside the Oregon and you may along side Us.

According to particular USDA loan you find attractive obtaining capital not as much as, you will get around 115% of the average income on your state nevertheless qualify for that it low interest financing. Like, when you find yourself a family group off five residing the newest Eugene/Springfield city, you could make to $74,750 a-year and be considered below USDA guidance.

There is not a set amount your credit rating need to meet to be eligible for this type of loan. Your credit report plus earnings might possibly be analyzed to choose your capability in order to meet installment debt.

Looking for an effective USDA Acknowledged Home during the Oregon

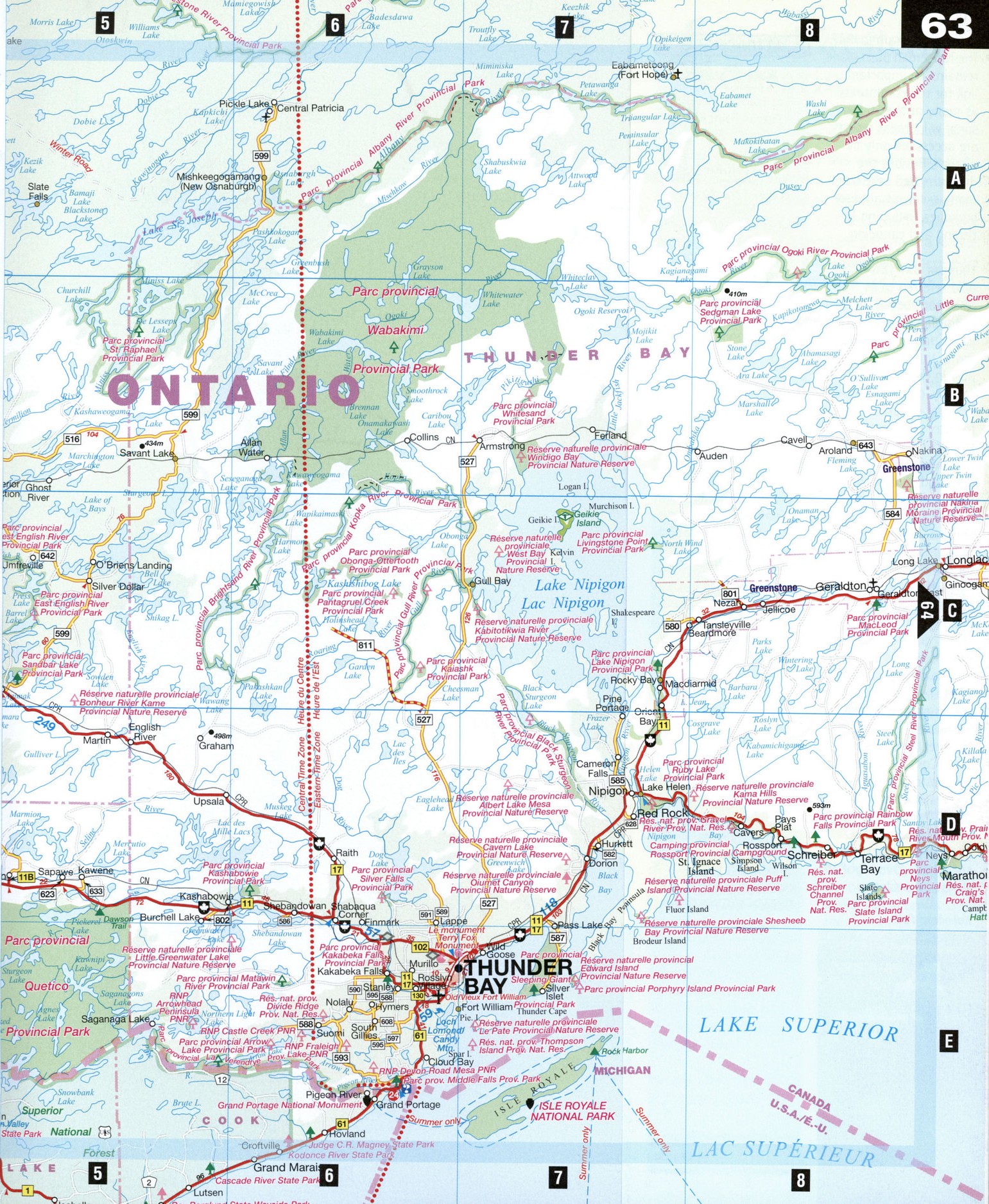

Title USDA financing can be somewhat misleading as it carry out cause you to trust, you need to be in the center of agriculture nation to help you qualify. Not. This method exists to help you organizations having populations out of 20,000 or smaller. It means cities such Wilsonville, Sherwood, Troutdale, Ashland, The fresh new Dalles and Pendleton the qualify for which financing certainly of numerous far more locations and you will metropolises regarding the state.

Besides for loans Raymer First-time Homebuyers

If you already very own a home, you could potentially still receive an enthusiastic Oregon USDA Home loan, however, you will find some constraints to help you qualifying. Whether your newest residence is uninhabitable, your family keeps outgrown it, it is a made home, or perhaps is not when you look at the fair travelling distance of your own host to really works, you could potentially still be eligible for which 100% funding mortgage!

Oregon USDA Mortgage brokers allow it to be gift suggestions out of members of the family and non-friends as well as provider closure rates advice. It means there is the odds of bringing a USDA domestic loan with near to zero with your own money costs.

If you’re seeking discovering for those who qualify for an enthusiastic Oregon USDA Mortgage otherwise speaking with our Oregon Mortgage brokers regarding the individuals applications we have offered, simply submit all of our Fast Reaction mode or give us a good call in the local part place of work located in Lake Oswego in the (503) 840-6400. All of our educated mortgage advantages would love to sit back and you will explore your circumstances. I look forward to reading away from you!

Here’s what You have to know In the USDA Money

The us Agencies from Farming (USDA) loan program was created to help to improve the new lifetime of them within the outlying The united states courtesy homeownership. It all first started inside 1935 when President Roosevelt signed an administrator purchase setting up this new Resettlement Government. This administration are such of good use inside the Great Despair giving help to family and you can providing them move around in. Over time, so it act are longer to incorporate the brand new USDA Outlying Advancement Institution, and that today administers USDA lenders.

Today, new USDA also offers lowest-desire mortgage loans having zero per cent off that will be readily available for People in america who happen to live during the outlying parts and may also not have the credit so you can be eligible for a timeless financial. This program promotes economic growth in portion that will not discover high increases if you don’t. Using this type of loan, individuals having a credit history as low as 640 is meet the requirements getting a home loan which have rates of interest as little as 1%.

Version of USDA Financing

You will find 2 kinds of USDA financing, the newest USDA Single-Family members Lead Mortgage and the Unmarried-Family unit members Guaranteed Mortgage. One another were created to increase homeownership inside the rural and you may residential district section but are totally different. The brand new protected financing is meant for lowest-to-moderate-money group and is the most famous. Brand new head mortgage is actually for really low-earnings group. The real difference during these loans is where he could be funded. On the head financing, the brand new USDA ‘s the lender, when you are a guaranteed loan may be received due to some other mortgage bank. Whichever station is drawn, each other finance try supported by brand new USDA.

Who’s Qualified

The majority of people tends to be shocked to get which they meet the standards so you can be eligible for a good USDA home loan. Very first, you truly must be an excellent U.S. citizen otherwise had been granted long lasting abode. You’ll also must give proof of money. Plus, your own month-to-month homeloan payment have to be 31% otherwise a reduced amount of their monthly earnings just like the remainder of your own monthly premiums (playing cards, vehicle payments, etcetera.) never surpass 41% of one’s money. Just remember that , the greater obligations ratios are believed in the event the your credit score is actually a lot more than 680. Whenever you are you’ll find money restrictions to help you be eligible for a USDA house financing, it varies because of the area and you can household dimensions. There are what the limits 800 mortgage poor credit was on the condition your location right here.

Ideas on how to Implement

Once you’ve determined that you’re qualified, making an application for a good USDA loan is much like any other kind away from mortgage. The initial step is to find an approved lender and possess prequalified. You may then want to discover a USDA-acknowledged home. Once you sign a buy agreement, you will then wade the fresh new control and you may underwriting just before closing.

We could Let

The loan processes would be difficult adequate and we understand that the new USDA financing techniques may sound overwhelming. However, searching for a loan provider that is used to new detail by detail facts and you can makes it possible to navigate the process effortlessly makes all the huge difference. Silverton Mortgage are proud provide USDA funds to the people which meet the requirements. Our very own knowledgeable mortgage originators will be ready to answer your questions to find out if a good USDA loan is right for you. Call us now to discover how exactly we makes it possible to look for the brand new American dream of homeownership.