Are you currently desperate for and pay for pretty good, secure, hygienic casing? If that’s the case, then you definitely ent financing. Degree is determined by the space where you live, and there are also earnings limits.

On this page, we will display that is eligible, some great benefits of an outlying Innovation mortgage, as well as how borrowers are able to use the loan money.

What is actually a USDA Outlying Invention Loan?

The united states Institution from Agriculture even offers an outlying Innovation loan system you to assists lenders when you look at the getting lower- and moderate-income domiciles the chance to very own adequate, small, pretty good, safe and sanitary homes because their pri, the newest USDA assisted 127,000 family purchase otherwise repair their homes, and yet, of numerous eligible Us americans however don’t know the system can be found.

For example additional federally secured mortgage apps, individuals don’t need to make a down-payment in order to safer a low-rate of interest loan. In the event the borrower chooses to, they can build a down-payment, but loan providers do not require they.

Why does it Functions?

Identical to Virtual assistant and you may FHA financing, the us government promises Rural Creativity loans, and you will borrowers aren’t necessary to generate a downpayment. The latest make sure handles financial loan providers out of consumers which could possibly get standard on the mortgage payments.

Rural Invention financing consumers might have to pay a mortgage insurance premium and their monthly mortgage payments. Brand new debtor pays the month-to-month superior, but the insurance coverage actually covers the lending company. If the borrower default to the mortgage, the loan insurance policies do spend the money for lender a portion of the loan prominent.

Consumers are able to use the USDA mortgage currency to order a property or even renovate, repair, otherwise update their established top quarters.

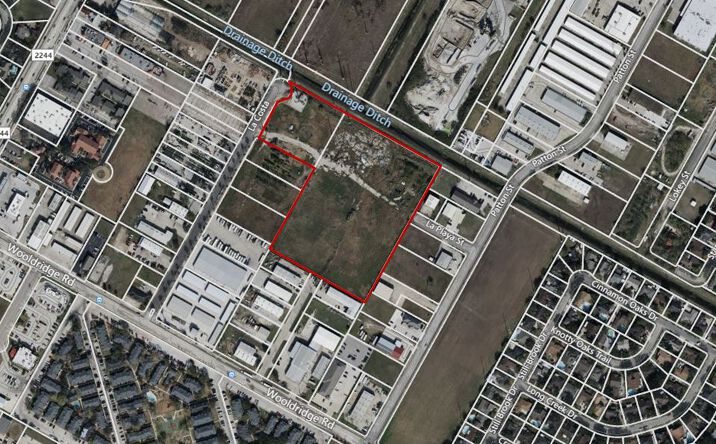

Rural Creativity Qualified Parts

The USDA Outlying Development fund are available to people that real time for the rural section. People out of metro areas aren’t generally qualified to receive the application form, but it is you can easily to acquire short purse off eligibility when you look at the residential district section. Check out the USDA web site to see if you reside a keen eligible area.

Usually, eligible homes have 2000 sq ft regarding living space or reduced. Maximum dollars amount of the mortgage varies centered on a keen applicant’s geography because accounts for the fresh area’s cost-of-living. Eg, some one living in California can get qualify for financing doing $five-hundred,000 once the cost-of-living was high, whenever you are those who work in less expensive midwestern parts may be eligible for good maximum of $100,000 regarding loan money.

Who can Apply?

Surprisingly, you don’t have become a beneficial rancher or a character when deciding to take advantageous asset of the latest USDA Outlying Development fund. Qualification is founded on place and you will money, not occupation.

USDA Outlying Development financing individuals normally have meet up with income qualifications conditions, and this are different centered on topography and you can family size. People must live in our home as their first house. People in america, non-resident nationals, otherwise Licensed Aliens get apply for the borrowed funds.

Loan providers can help a borrower determine how big mortgage the guy or this woman is eligible for predicated on venue and you can financial function. Oftentimes, a great borrower’s monthly homeloan payment (which has the principal, notice, insurance rates, and you can taxes) should be no more than 29% away from their particular monthly earnings.

Minimal credit rating necessary for a great USDA mortgage was 580, but people who have highest score will be eligible for most useful words. Anyone with a get regarding 640 otherwise reduced might require way more tight underwriting, very financing recognition can take prolonged. Unless you payday loans Section without checking account has a credit score, you may still have the ability to be considered with a great non-traditional credit site filled with your own power or rental fee background.

Not all outlying citizens was applicants to own good USDA home loan. Prospective consumers constantly you prefer a reputation dependable earnings to possess an effective at least 2 years before you apply for a loan. Of several loan providers also require that the debtor has not got one bills delivered to a profile department for one year before you apply for a financial loan.

How do you Utilize the Money?

Consumers may use the mortgage financing to order a different sort of otherwise existing possessions, as long as it is their first household. The loan money could also be used to greatly help the debtor pay closing costs or other reasonable costs associated with a normal household business. Consumers can even make use of it to own professional-rata a home fees on closing, together with their chances and you may flooding insurance fees.

- Repairs otherwise renovations away from a preexisting house

- Refinancing eligible loans

- Specifically designed features or devices to suit a family associate just who features an impairment

- Reasonable costs so you can reconnect utilities (h2o, sewer, gasoline, electrical), along with professional-rata repayment can cost you

- Crucial family equipment, including carpet, range, refrigerator, washing machine, more dry, or Heating and cooling gizmos

- Web site planning for the a separate household create seeding otherwise sod, progressing the building site, fences, or driveway