Securing home financing that have an average credit history around australia are feasible, although it may come with certain pressures such as for example high focus cost or more strict loan conditions. By enhancing your credit score, evaluating various home loan also provides, and perhaps talking to financial experts, you could potentially enhance your probability of shopping for home financing that fits your debts.

Looking to safer home financing which have the typical credit rating may search tough, but it’s yes you can easily. Skills exactly what the typical credit rating try and you will examining the offered possibilities can be unlock doors in order to protecting a mortgage around words that fit your debts. This article will book potential homeowners from the means of getting a home loan having the common credit history around australia.

Information Credit ratings around australia

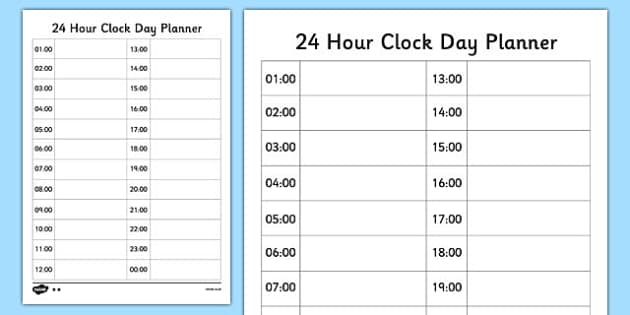

Around australia, fico scores usually start around 3 hundred to help you 850. The typical credit history tends to be considered on middle range, as much as five hundred so you can 700, according to credit scoring company. Take a look at dining table less than, which shows the newest ranges for ‘average’ credit score, to own Equifax, Experian and you may Illion.

Credit scores are important while they influence a beneficial lender’s decision into the whether to give you a home loan as well as on what terms and conditions. A high rating implies best creditworthiness, resulting in best interest levels and favourable financial conditions.

Challenges having a home loan which have the average Credit score

With the common credit rating could possibly get curb your home loan solutions and you may change the terms of the mortgage. Loan providers you will understand your as increased chance as compared to some one that have a top get, that’ll end up in high interest rates or a need for more substantial downpayment. Simultaneously, the borrowed funds approval processes would-be even more stringent, requiring more comprehensive records to show debt balances.

Mortgage Choices for Those with Mediocre Credit scores

- Old-fashioned Mortgages: While stringent, conventional loan providers carry out accept consumers with mediocre ratings, usually changing mortgage terminology to decrease chance.

- Unique Apps: Specific loan providers provide software specifically made for those having mediocre borrowing from the bank score. These types of might are quite large interest levels but alot more versatile qualification conditions.

- Non-Financial Lenders: This type of institutions normally have more flexible lending conditions than conventional banking institutions and can even become a viable solution.

Enhancing your Credit history Before applying

- Typical Repayments: Ensure you pay all costs and present funds on time.

- Credit file Checks: On a regular basis look at the credit file to possess discrepancies otherwise outdated pointers.

- Straight down Credit Utilisation: Keep the credit card balances really beneath the limitations.

Records and needs

- Proof Earnings: Spend glides, tax returns, and you can employment info.

- Economic Statements: Lender statements and any other financial property.

- Credit score: Done information on your credit report, and additionally financing, playing cards, or any other obligations.

Contrasting Other Financial Also provides

Looking around is extremely important for no wait cash advance Ovid, CO those who have the average credit rating. Explore systems such as for instance on the internet mortgage hand calculators and you will assessment websites to compare various other mortgage also offers. Research not merely at rates in addition to on charge, mortgage keeps, and you will independence to find the best complete worth.

Case Degree

Take into account the tale out-of Victoria, an instructor in the Melbourne which have a credit score off 650. She effectively covered a mortgage after looking around and you may looking an effective lender one searched past her credit rating so you’re able to their particular longstanding a career and minimal loans. Victoria’s instance illustrates that with effort and you may careful considered, obtaining a home loan having the typical credit history is achievable.

Qualified advice

Monetary advisors and you may mortgage brokers also have invaluable advice for navigating the borrowed funds process having the common credit score. They could promote personalised procedures according to the money you owe and you will needs. Such as for instance, they may suggest would love to implement up to shortly after improving your borrowing from the bank get otherwise considering certain loan providers that happen to be noted for a great deal more versatile credit standards.

Conclusion

And also the typical credit rating could possibly get expose some demands in the the loan software processes, it generally does not stop you from getting a home loan in australia. Having cautious preparing, just the right bank, and perhaps particular qualified advice, you will find a mortgage that fits your debts.