Meters ore than simply a 3rd (36%) regarding property owners old more than 40 point out that and then make changes on their house otherwise garden was the concern when you look at the old-age. But if you have reached this milestone as well as the loans to funds home improvements commonly instantly readily available, attempt to think carefully about the most practical way to finance home improvements.

Whether or not we wish to update your cooking area, create a conservatory otherwise move their loft to create a supplementary room, the cost might possibly be steep. Like, a frequent attic conversion process will set you back ?step 1,step 150-step one,350 for every square metre nonetheless it will add as much as 20 percent towards house’s value.

It is a good idea to get prices from at the least around three various other designers, due to the fact costs differ widely according to the types of sales. Before you will do actually one, it seems sensible to decide the best way to loans your property advancements. They are the five top ways:

- Additional borrowing from the bank toward a home loan

- Establishing collateral

- Home improvement money

- Playing cards

- Do you have the skills you would finance family renovations? See when the collateral launch may help you open income tax-100 % free cash from your own home – Was this new totally free calculator now.

step 1. Borrowing from the bank with the a home loan for renovations

While you are and also make high alter that need a more impressive sum, borrowing a lot more on your home loan is one way to increase funding to possess home improvements. But not, remortgaging isn’t really always quick for old individuals, because the loan providers want to see facts that you’ll have a stable money when you retire. They could and additionally consent in order to lend more a smaller label, that imply steep costs.

As with any financial borrowing from the bank, you will find a threat of repossession whenever you are struggling to carry on with the fresh money. You might be interested in the additional prices on it due to the interest paid back more than any kind of time period you used to be to extend their financial of the. For most, delivering which chance when you look at the retirement, simultaneously if for example the money does slide, are not a good choice.

2. Guarantee release for home improvements

Instead of borrowing a lot more on the home financing having renovations, elderly residents can also be launch collateral using their residential property to cover the price of renovations. That have a life financial, the latest UK’s best collateral release device, you might release a portion of their home’s value just like the good tax-100 % free dollars lump sum.

Instead of having month-to-month payments, that have an existence home loan the borrowed funds and attract and this rolls up over time usually are paid towards the guarantee launch provider only when the brand new past homeowner becomes deceased otherwise comes into a lot of time-name care. Normally, this is certainly hit to your business of the home.

If interest move-right up inquiries you, there are also possibilities where you can build voluntary payments to your financial, if or not which is to blow the eye monthly or to reduce this new a fantastic count throughout the years. If you want to avoid this type of payments, you certainly can do very any time as opposed to punishment.

It is vital to keep in mind that of the opening collateral from your own domestic today you will reduce the amount offered to the property later on. When you find yourself permitted function-checked benefits, then opening equity could also apply to you to entitlement.

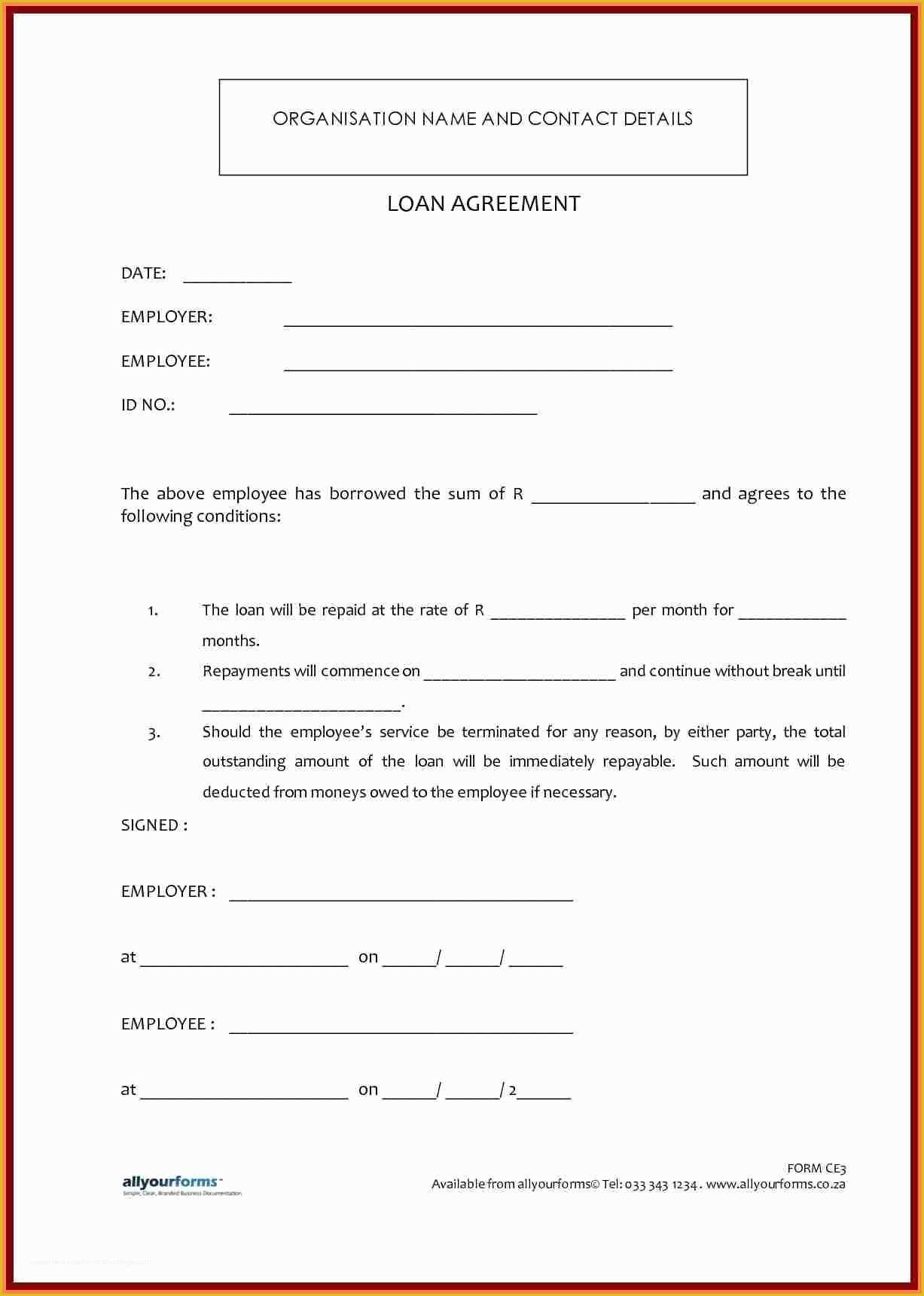

3. Do it yourself finance

Property improvement financing is almost certainly not your best option getting older individuals that will cause them to bear an obligations inside retirement that needs repair. Think twice about how precisely a lot of time make an effort to pay-off the fresh financing if you are considering this method.

In contrast, that have security launch, whenever you are providing a loan, you don’t need to make money. And additionally, every agreements of Collateral Launch Council-acknowledged loan providers keeps a zero-negative guarantee ensure, which means you cannot are obligated to pay more the worth of your property. Given that count you owe isn’t really owed getting repayment until you perish or enter into permanent much time-title worry, the main concern is you to definitely initiating guarantee wil dramatically reduce the importance of the estate through the years.

4. Playing with credit cards to fund home improvements

Whenever you are just and work out minor transform to your possessions, you could decide on credit cards to pay for will cost you.

Such as, you might be attending bring your house another brand new be by the redecorating, that pricing anything from multiple to help you plenty personal loans Nashville OH, depending on the the total amount of the change.

When deciding on a charge card, consider opting for one to that have a long 0% Apr introductory months, as you you may repay your balance before you could is billed appeal. Bear in mind that we’re not giving suggestions about the new use of playing cards, and ought to you get one recognition could be subject to debt things and you will credit rating.

Consider carefully your financial support with this security discharge lover

If you decide that you would like the new comfort away from watching the new renovations without the need to generate instant payments to have resource her or him, then collateral launch would-be a worthwhile idea to you personally.

Simultaneously, since there is a choice to generate voluntary repayments on the amount borrowed when opening equity, this one could offer far more independence than many other streams.

And even though its worth considering that the types of financial support domestic developments will certainly reduce the worth of your own house, utilizing the security released from your own home and make improvements are attending raise the worth and you will mitigate several of it impression.

So you’re able to learn your own security discharge alternatives, brand new Telegraph Media Category keeps hitched with prize-effective equity launch pros In control Equity Discharge. Utilizing the calculator, you can learn how much taxation-totally free bucks you happen to be eligible to launch. You may want to discover a totally free self-help guide to equity release of the article and you can email address, as well as tune in to from their friendly Guidance Team.

In control will in addition be able to address any queries you might have, together with guide you a zero-duty meeting having a completely accredited agent.

By taking currency from the assets today, an existence home loan wil dramatically reduce the value of the home. A lifestyle mortgage may also connect with their entitlement so you can function-checked professionals, however, an agent can also be take you step-by-step through the impression of before you decide to proceed.

The newest Telegraph Security Launch Service is provided by the In charge Equity Release. In control Guarantee Launch is an investments sorts of In charge Lives Restricted. In control Lifetime Restricted is authorised and you will regulated by Economic Carry out Power and is joined toward Financial Functions Check in ( less than reference 610205. Only when you choose to just do it and your circumstances finishes will In control Lifestyle Restricted fees a suggestion percentage, currently maybe not surpassing ?step 1,690.

The above blog post was created to have Telegraph Economic Alternatives, a member of Telegraph News Group Restricted. More resources for Telegraph Economic Alternatives, click on this link.